Empower Your Financial Trip with Committed Loan Services

Empower Your Financial Trip with Committed Loan Services

Blog Article

Discover the Perfect Funding Solutions to Satisfy Your Financial Objectives

In today's complex economic landscape, the pursuit to discover the ideal car loan services that straighten with your one-of-a-kind economic objectives can be a complicated job. With various choices available, it is crucial to browse via this labyrinth with a calculated strategy that guarantees you make notified decisions (Financial Assistant). From recognizing your monetary requirements to evaluating lending institution online reputation, each action in this process needs careful factor to consider to protect the finest feasible end result. By complying with a methodical approach and considering all aspects at play, you can position on your own for financial success.

Examining Your Financial Needs

When considering finance solutions for your financial goals, the preliminary action is to thoroughly assess your present monetary demands. This analysis is essential as it sets the foundation for establishing the kind of lending that aligns finest with your demands. Begin by reviewing the specific purpose for which you need the finance. Whether it is for acquiring a home, moneying education and learning, expanding your company, or combining financial debt, recognizing the objective will certainly aid in picking one of the most appropriate finance item.

Furthermore, it is vital to conduct a thorough testimonial of your present financial situation - mca loan companies. Determine your revenue, costs, assets, and obligations. This evaluation will give a clear photo of your economic health and wellness and settlement capacity. Think about variables such as your credit score, existing financial debts, and any upcoming costs that might influence your capacity to pay back the financing.

Along with recognizing your monetary needs, it is advisable to research and contrast the loan options offered out there. Various car loans featured differing terms, passion prices, and repayment schedules. By meticulously examining your requirements, monetary position, and readily available financing items, you can make an enlightened decision that supports your economic goals.

Understanding Loan Choices

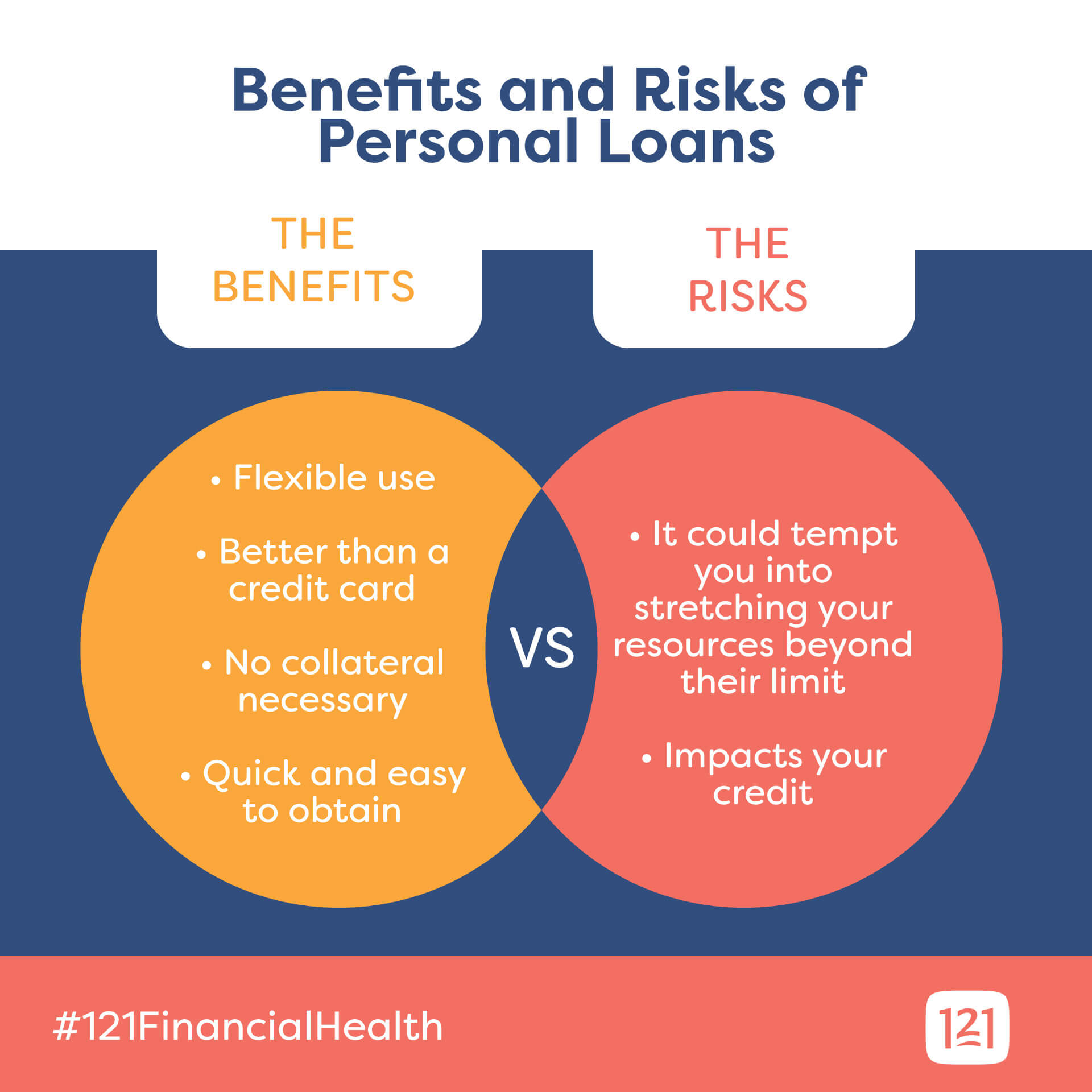

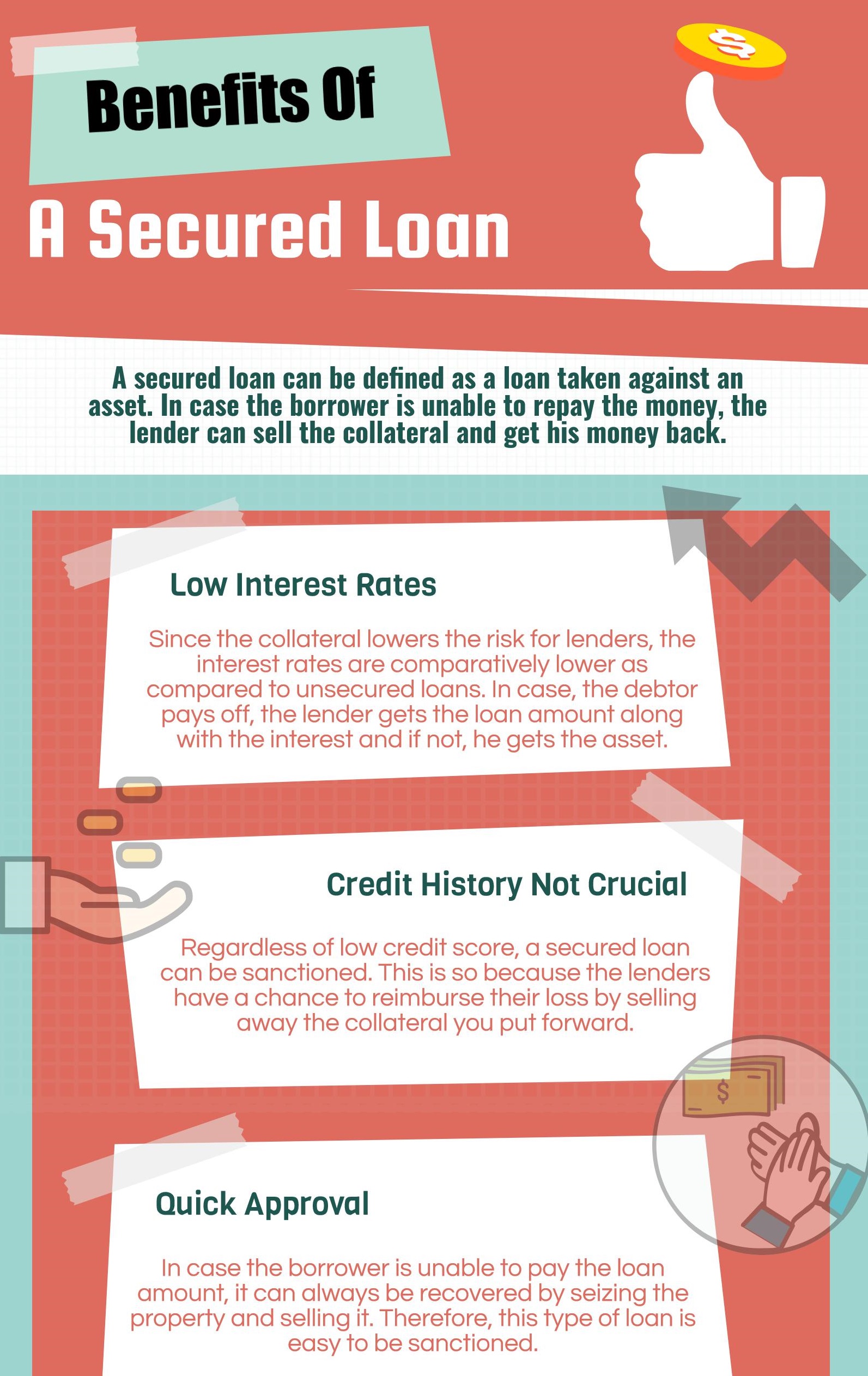

Checking out the array of finance choices readily available in the financial market is essential for making notified decisions aligned with your details requirements and objectives. Understanding funding choices includes acquainting yourself with the numerous types of financings supplied by banks. These can range from standard alternatives like personal finances, mortgages, and car loans to much more customized items such as home equity car loans, payday advance loan, and student finances.

Each sort of car loan includes its very own terms, problems, and settlement structures (mca funding companies). Individual finances, for example, are unsecured financings that can be utilized for various objectives, while home loans are secured financings particularly designed for acquiring property. Vehicle fundings accommodate funding vehicle acquisitions, and home equity car loans permit property owners to obtain against the equity in their homes

Contrasting Rates Of Interest and Terms

To make informed choices regarding financing options, a critical step is contrasting rate of interest and terms offered by monetary establishments. Rate of interest determine the expense of obtaining cash, impacting the overall amount settled over the funding term. Reduced rates of interest suggest reduced overall expenses, making it crucial to seek the very best prices readily available. Terms refer to the conditions of the finance, consisting of the repayment blog period, charges, and any kind of added requirements set by the loan provider. Recognizing and contrasting these terms can help customers select one of the most ideal lending for their monetary circumstance. When contrasting rates of interest, take into consideration whether they are dealt with or variable. Fixed rates remain constant throughout the funding term, supplying predictability in settlement quantities. Variable prices, on the various other hand, can rise and fall based upon market problems, possibly influencing monthly settlements. Additionally, assess the impact of car loan terms on your monetary objectives, ensuring that the chosen lending aligns with your budget and lasting objectives. By carefully assessing interest rates and terms, customers can choose a finance that ideal satisfies their demands while lessening expenses and threats.

Reviewing Lender Online Reputation

Furthermore, think about contacting regulatory bodies or financial authorities to ensure the lender is licensed and certified with market guidelines. A credible lender will have a strong record of honest lending techniques and clear interaction with customers. It is also advantageous to seek referrals from close friends, family members, or monetary advisors that might have experience with credible loan providers.

Ultimately, picking a loan provider with a strong reputation can give you assurance and self-confidence in your borrowing choice (merchant cash advance loan same day funding). By carrying out complete study and due diligence, you can select a lender that straightens with your financial goals and worths, establishing you up for an effective borrowing experience

Selecting the very best Finance for You

Having completely assessed a lender's reputation, the following important step is to meticulously choose the ideal funding option that aligns with your economic goals and needs. When picking a funding, consider the objective of the finance.

Compare the rate of interest, funding terms, and fees provided by different lending institutions. Reduced rates of interest can conserve you money over the life of the loan, while positive terms can make repayment extra manageable. Consider any kind of additional prices like origination charges, prepayment charges, or insurance coverage requirements.

Pick a loan with monthly repayments that fit your spending plan and duration for settlement. Eventually, choose a financing that not only meets your existing economic requirements but also supports your lasting economic goals.

Conclusion

To conclude, finding the perfect car loan services to fulfill your financial goals requires a thorough analysis of your economic requirements, comprehending funding choices, comparing rate of interest and terms, and examining loan provider reputation. By carefully taking into consideration these aspects, you can choose the best lending for your details scenario. It is essential to prioritize your financial purposes and select a car loan that aligns with your lasting monetary goals.

Report this page